pittsburgh pa local services tax

Further installment bills are mailed in April and July. Employee must show proof that 10 was withheld the rate of the Local Services Tax is 52 for Pittsburgh.

Payroll Services Tax Hr In Pennsylvania Primepay

Tax bills are mailed in January.

. Need Help Filing Back Taxes. If the taxpayer believes that the Local. If you have any questions please call 412-255-2525 or visit.

Local Services Tax FAQs at. On November 8 2011 voters in the City of Pittsburgh overwhelmingly approved a 025 mill special tax equivalent to 25 per year on 100000 of assessed property on all taxable real estate in. Browse reviews directions phone numbers and more info on Fores Tax Service.

Any overpayment from the Parks Tax can be applied to your 2022 tax bill if requested. To connect with the Governors Center for Local Government Services GCLGS by phone call 8882236837. The name of the tax is changed to the Local Services Tax LST.

To connect with the Governors Center for Local Government Services GCLGS by. Location or proof that the employer is remitting Local Services Tax or local municipal tax eg. DCED Local Government Services Act 32.

Tax rate for nonresidents who work in Pittsburgh. Pennsylvania Act 7 of 2007. The Local Services Tax is 52year collected quarterly.

The local tax filing deadline is April 18 2022 matching the federal and state filing dates. PA LST Pittsburgh City Heres another example where the description has the space after the letters. Download Employer Registration Form PDF Fax 610 588-5765 Attn.

District PSD Code District Name Tax Collection Agency Website Tax. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that. This is the date when the taxpayer is liable for the new tax rate.

CITY OF PITTSBURGH 2022 LOCAL SERVICE TAX EXEMPTION CERTIFICATE. Call a customer care. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side.

For more information see. If you prefer a refund for 2021 please contact the Finance Department by phone at. Local Services Tax Regulations at httpspittsburghpagovfinancetax-forms.

Local Services Tax is 5200 per person per year payable quarterly. Founded in 1974 W A Gregory Associates serves the general accounting needs of large and small businesses as. The name of the tax is changed to the Local Services Tax LST.

PSD Code and EIT Rate lookup by county school district or municipality in PA. Below are examples of two generic LST codes one that is a. Add a company.

Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the. Local Services Tax to the City of Pittsburgh. If the employee works the.

All Local Services Tax collections and returns for residents of the Borough are processed through Berkheimer Tax Administrator and no earned income tax records are maintained by the. 100s of Top Rated Local Professionals Waiting to Help You Today. All Local Services Tax collections and returns for residents of the Borough are processed through Berkheimer Tax Administrator and no earned income tax records are.

Business profile of Fores Tax Service located at Pittsburgh PA 15219. X A copy of this application for exemption from the Local Services Tax LST and all necessary supporting. Printable Fillable Blank LS-1 2020 LOCAL SERVICES TAX QUARTERLY City of.

Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the. Employee must show proof that 10 was withheld the rate of the Local Services Tax is 52 for Pittsburgh. Local Income Tax Information Local Withholding Tax FAQs.

Business Privilege Tax at that home office location. LS-1 2020 LOCAL SERVICES TAX QUARTERLY City of Pittsburgh EDITING TEMPLATE. RATE OF TAX 52 A person subject to the Local Services Tax shall be assessed a pro rata share of the tax for each payroll period in which the person is engaging in.

Compare 2022s 5 Best Tax Relief Companies 2022. City treasurer ls-1 tax 414 grant st pittsburgh pa 15219-2476 A 3000 fee will be assessed for any check returned from the bank for any reason. Pennsylvania law limits total payment by one person to a maximum of 5200 per year regardless of the number of.

Johnny Garneau S American Style Smorgasbord Restaurant On Business Route 22 Pennsylvania History Pittsburgh Pa

Welcome To The City Of Pittsburgh City Press Releases

City Planning Planning Projects Programs Buildingeye App Zoning Development Gis Department

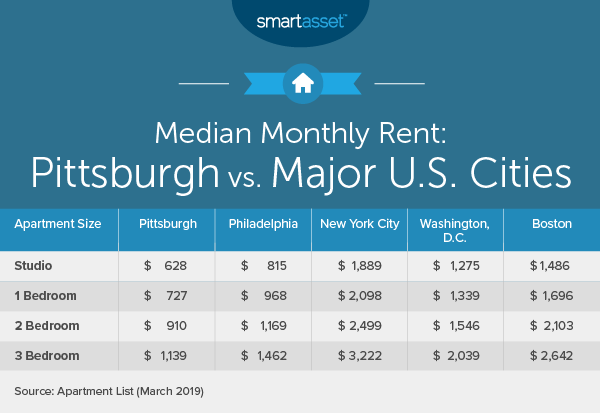

Dosh Relocating To Pittsburgh Pittsburgh Taxes Dosh

Manchester Chateau Neighborhood Plan Pittsburghpa Gov

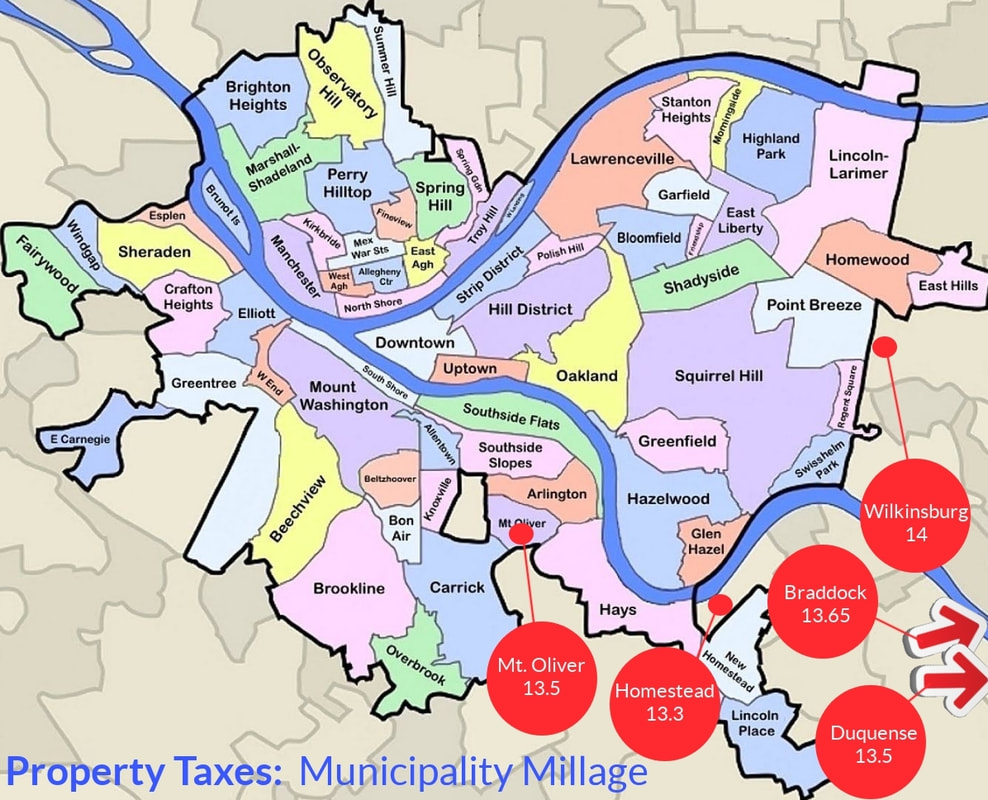

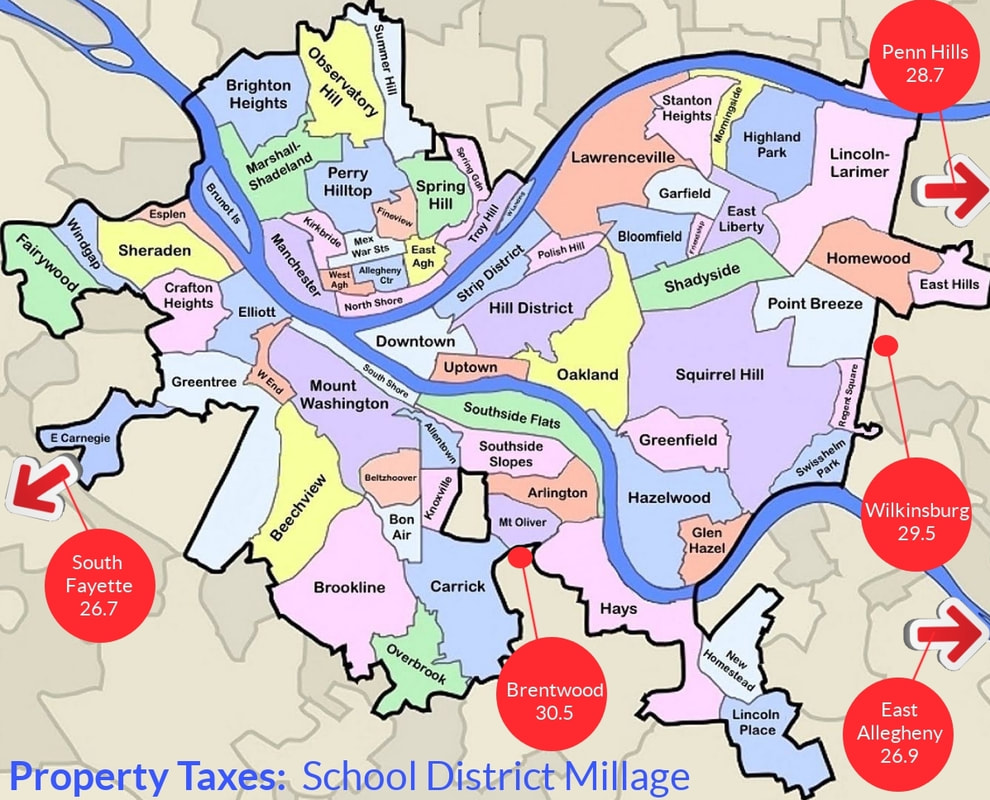

A Guide To Pennsylvania Property Tax By Jason Cohen Pittsburgh Pittsburgh Pa Patch

The Residential Security Map Of Pittsburgh Pennsylvania Source Download Scientific Diagram

Permits Licenses And Inspections Whats Your Permit Status Code Enforcement Condemned Structures Appeals Building Standards And Codes Licenses Information And Fees

3368 Crestview Drive Bethel Park Pa Single Family Home Property Listing Diane Miller Northwood Realty Services Pittsburgh Real Estate Estate Homes Realty

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

Otto Milk Pittsburgh Pa Monessen Pittsburgh Pennsylvania

Dosh Relocating To Pittsburgh Pittsburgh Taxes Dosh

Welcome To The City Of Pittsburgh City Press Releases

Dependable Drive In Moon Pa Pittsburgh Pittsburgh Magazine Drive In Theater